ประวัติศาสตร์การพัฒนา

สำหรับ ACU นับตั้งแต่ก่อตั้ง เรียกได้ว่ามีพันธกิจที่สำคัญในการสร้างสกุลเงินเอเชียให้เป็นหนึ่งเดียว เพื่อส่งเสริมโลกาภิวัตน์ของเศรษฐกิจโลก

In 2019, the idea of promoting the Asian dollar has been discussed for more than 20 years, and over 13 years the ACU has paved the way by building a bridge for the internationalization of the yuan.

วิสัยทัศน์:

เราเชื่อว่าสกุลเงินดิจิทัลสามารถทำให้ธุรกรรมทางการเงินมีความยุติธรรม ความโปร่งใส ความปลอดภัย และมีประสิทธิภาพมากยิ่งขึ้น

ภารกิจ:

อุทิศตนเพื่อส่งเสริมให้สกุลเงินดิจิทัลมีความสะดวก ปลอดภัย เชื่อถือได้ และเป็นที่ต้องการในการทำธุรกรรมมากที่สุดในโลก

ค่านิยมองค์กร:

1. มีความซื่อสัตย์และปฏิบัติตามกฎระเบียบ 2. มีความปรองดองสามัคคี 3. มีความน่าเชื่อถือและสะดวกสบาย 4. มีนวัตกรรมและความเป็นเลิศ

ประวัติการพัฒนา ACU

At the World Bank and IMF Annual Meeting, Japan proposed the idea of establishing an Asian Monetary Fund. It advocated the formation of an organization involving Japan, China, South Korea and ASEAN countries to raise 100 billion U.S. dollars.

At the Second ASEAN Informal Summit, based on the lessons learned by the Southeast Asian countries from the financial crisis, Malaysian Prime Minister Mahathir was the first proposed "Asian Dollar Zone" vision.

At the “10+3” Finance Ministers Meeting, the finance ministers of all countries signed up the “Chiang Mai Initiative” and compromised the adoption of financial cooperation clauses to extend the scope of currency swap agreements between ASEAN member countries to China, Japan and South Korea.

During the APEC meeting in Shanghai, “the father of the euro” Mundell predicted: “The world will have three major currency zones, namely the Eurozone, the US Dollar Zone and the Asian Dollar Zone.

Japanese Finance Minister Masajuro Shiokawa predicted at the ASEM meeting that a unitary Asian Dollar, Asian central bank and currency union will emerge around 2030.

Mundell suggested setting up a common currency consisting of a basket of currencies in the Asian region, therefore each country can circulate in Asia without abandoning its own currency.

The “10+3” leaders in East Asia regard the “East Asian Community” as a long-term common goal direction.

At the Boao Forum for Asia in 2005, the Chief Executive of the Hong Kong Special Administrative Region, Donald Tsang, made it clear that the unified currency has the concept of Asian unification and that Asia needs a unified currency.

The Asian Development Bank said that ADB is designing the concept of “Asian Dollar”.

The Asian Development Bank revealed to the media that the bank will calculate the Asian Union's common foreign exchange indicator, the Asia Currency Unit (ACU).

In a joint statement issued by Hyderabad, the “10+3” finance minister announced that they would support research topics that explore the ways of creating regional monetary units.

US Deputy Finance Minister Tim Adams mentioned at the World Economic Forum meeting in Tokyo that the United States does not object to establish of Asian currency units.

Japan and China expressed support for the establishment of the Asian dollar.

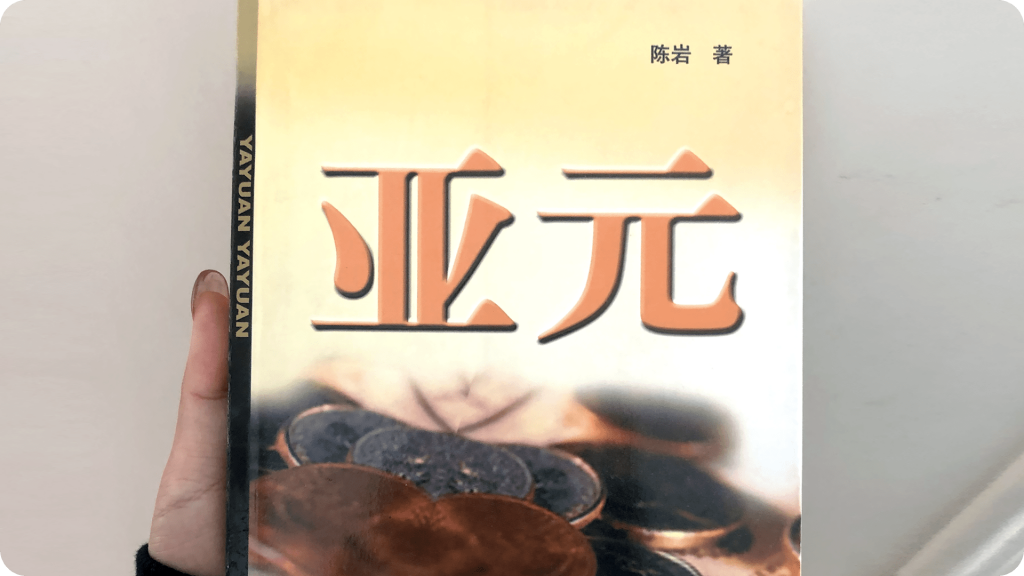

Chinese economist Chen Yan published a book entitled "Asian Yuan", stating that the "Asian dollar program is based on an assessment of Asian currency integration. The purpose of the program is to obtain the interest and strengthen the Asian common currency, achieve the Asia peaceful, stability, prosperity, and enhance the overall status of Asia in the world."

China, Japan, South Korea, and 13 leaders of Asian countries such as ASEAN reached an agreement in Beijing to set up a $80 billion joint fund by June 2009.

During the Boao Forum for Asia, Iran's First Vice President Parviz Davoodi stressed that Asian countries should use their own currency when they settled their trade, and eventually form a unified Asian dollar.

The “10+3” finance ministers meeting came up a consensus on the US$120 billion Asian regional foreign exchange reserve and determined to launch the “Asian Monetary Fund” prototype at the end of 2009.

The “10+3” finance ministers and central bank governors' meeting clarified that countries can use the local currency and the US dollar to implement swaps in a foreign exchange reserve with a total size of US$120 billion. The scale was then further expanded to $240 billion.

Chairman of the Boao Forum, former Japanese Prime Minister Yasuo Fukuda, expressed his expectation during the Boao Forum was to promote the Asian currency soonest.

The Asian Development Bank published the effectiveness of the Asian Unified Currency Index on the management of East Asian economies, further demonstrating the role and importance of the Asian Dollar.

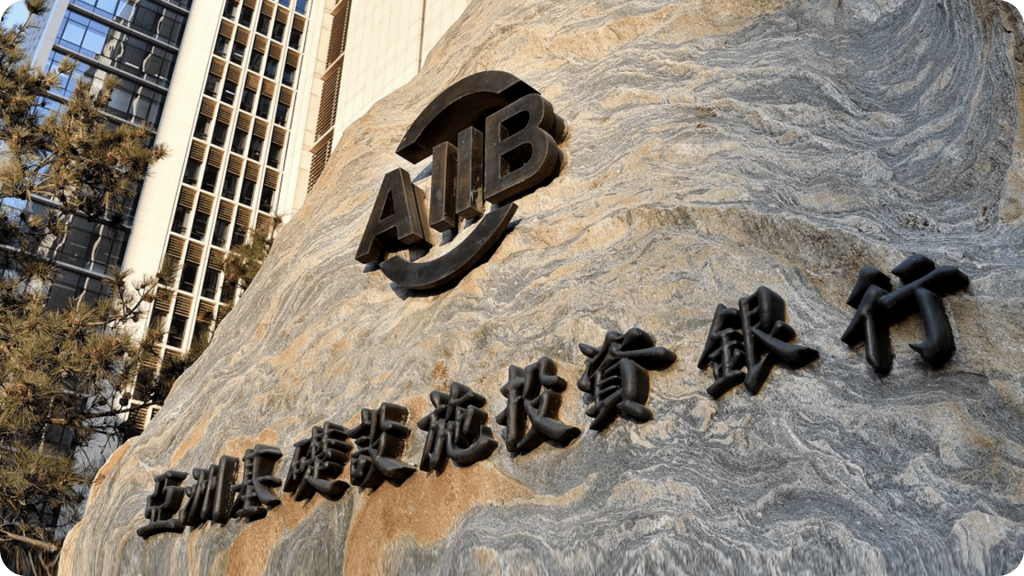

The Asian Infrastructure Investment Bank planned to issue the Asian Dollar.

Chinese economist Song Hongbing proposed in the "Currency War 4: The Warring States Period" that China should dominate the process of the Asian Dollar, by using the currency leverage of the Asian Dollar to activate all aspects of cooperation in Asia, and ultimately form a full leverage against the US dollar and the Euro .

The Asian Infrastructure Investment Bank handed over the trademarks of "Asia Currency Unit - ACU" for 46 countries around the world to the Asia Digital Currency Limited.

The Asia Digital Currency Limited began to design and develop the exclusive ACU CNY stable digital currency and ACU wallet.

The Asia Digital Currency Ltd has accomplished into a strategic cooperation with the TACU Exchange, which will provide the ACU to theTACU Exchange as a digital stable currency in 2019.

Asia Digital Currency Ltd. was formally established in Hong Kong, and officially launched ACU digital currency based on the Hong Kong offshore RMB exchange rate as a 1: 1 anchor exchange rate.

The ACU wallet released version 1.0.1, officially providing services to ACU users and institutions.

At the G20 summit in Osaka, Japan, Malaysian Prime Minister Mahathir suggested that the “Asian dollar” should be based on gold because of the utmost stability nature. The "Asian Dollar" should be linked up with gold, which will expedite the acceptance of this cross-sovereign currency and gradually become the trading currency and reserve currency in between member states.

World Digital Currency Bank and Asia Digital Currency Limited signed a strategic cooperation agreement in Hong Kong , to reach a consensus on the global payment promotional business of ACU.

In September 2019, the Surinamese Government and the Asian Digital Currency Limited formulated strategic cooperation framework to jointly promote the internationalization of the ACU.

Maria Eugenia Amaya, the Panama consul in Hong Kong, visited the Asia Digital Currency Ltd and exchanged views on the ACU's concern of the landing in Panama.

Diplomat of the Dominica Republic: Will promote the ACU landing in Dominica Republic actively.

Francis Kwok, Chairman of Ferrari Group Asia, visited the Asia Digital Currency Ltd and both parties exchanged in-depth communication on the payment application in the Ferrari Group's industry, including the purchase of Ferrari cars by the ACU, the Ferrari theme park and the Ferrari star hotel.

The World Digital Currency Forum formally released ACU to the world and become the most dazzling star in the Forum.

ACU PAY has kick started in Thailand together with extension brands of ACU PAY Online Outlet and ACU PAY College.

Launching in Malaysia in Aug 2022.

The Asia Digital Currency Limited will reserve 100 tons of Gold as an endorsement of the ACU, and will carry out the omnidirectional service of the ACU more than 20 countries around the world.