Image by Ledger Insights

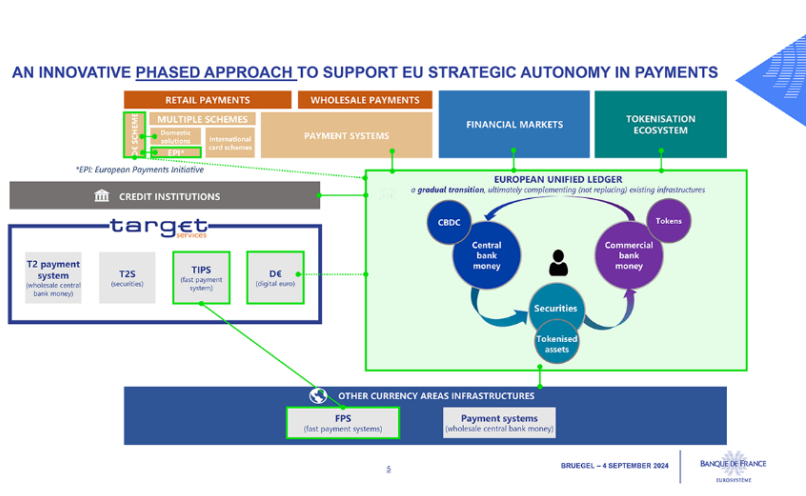

It’s well known that the Banque de France is a fan of wholesale CBDC and tokenization. It started running wholesale CBDC trials in 2020. In a speech yesterday, Governor François Villeroy de Galhau outlined his vision for a Capital Markets Union (CMU) and a Banking Union within Europe. An EU Unified Ledger is one of his strategies to improve payments.

He described the Unified Ledger as “a new public-private infrastructure built around a distributed ledger that would include a wholesale central bank digital currency (CBDC), tokenised commercial bank money and tokenised financial instruments, and potentially the digital euro later on. This shared infrastructure would streamline transactions, reduce risks and costs, and thus foster CMU, while preserving the two-tier financial system.”

Rather than a “big-bang” migration he suggests a phased approach targeting specific market segments. Those that currently involve manual or domestic processes might be at the front of the queue. However, he envisions it expanding to a range of tokenized assets and cross border functionality.

Retrieved from: https://www.ledgerinsights.com/eu-unified-ledger-for-tokenization-proposed-by-banque-de-france-governor/